Call To Order: 5:30pm

Invocation: Martinez Baptist Church Minister of Outreach Reverend Perry Ky

Pledge of Allegiance: Stevens Creek Elementary 4H Presidents

Special Recognitions

Georgia-American Choral Directors Association

Grovetown Middle School Chorus Teacher: Victoria Alvarez

Georgia Music Educators Association

Greenbrier HS Band Teachers: Dr. Brian Toney & Rutledge Boykin

Blue Ridge ES Music Teacher: Brittany Swann

Grovetown MS Chorus Teacher: Victoria Alvarez

Georgia Department of Education Literacy & Math Leader Schools

Literacy

Cedar Ridge ES: 3rd & 4th Grade Growth

Greenbrier ES: 3rd & 5th Grade Achievement

North Harlem ES: 3rd Grade Growth

Lakeside MS: 6th Grade Growth

Stallings Island MS: 6th Grade Growth

Math

Baker Place ES: 5th Grade Growth

Evans ES: 5th Grade Growth

Greenbrier ES: 3rd & 5th Grade Growth

Lewiston ES: 3rd & 5th Grade Growth

Martinez ES: 5th Grade Growth

North Harlem ES: 5th Grade Growth

Columbia MS: 8th Grade & High School Growth

Evans MS: 8th Grade Growth & High School Growth & High School Achievement

Greenbrier MS: 7th & 8th Grade Growth, High School Achievement & High School Growth

Grovetown MS: High School Growth

Riverside MS: 7th & 8th Grade Growth

Stallings Island MS: High School Growth

Harlem MS: 7th & 8th Grade Growth, High School Growth

Board Comments: Board members expressed gratitude for all of the hard work of the district, thanked 4H for leading pledge and the Reverend for the invocation.

Approval of Consent Items: Item B was pulled from consent for discussion. Approved A, C-G: Yay 5, No 0

A. 1/13/2026 Regular session meeting minutes

C. Budget Amendment

D. Fundraisers

E. Employee Travel

F. Program/Camp/Employer Participation Request

G. Lease/Use of Facilities

December Financials: Approve: Yay 5, No 0

Katie Allen: I noticed that we had added the 2027-2032 splost chart on here. Because we approved those bonds, I just wanted to ask. I see that the bond proceeds is at around $193.3 billion under the revenue and then under the debt, the principal and interest associated with that bond is about $64.8 million. So if my calculations are correct, that puts around $217 million remaining to be repaid for that bond over into futures losses. Right? That’s not documented on this financial report anywhere. Which financial document shows kind of a running debt total for all of our bonds?

Alex Casado: The best place for that would be the financial statements through the liabilities.

Katie Allen: As a board, are we good with only accounting for $64.8 million of that bond debt, even as we’re claiming 193.3 million of the proceeds within this loss and putting the rest of that into future spots? Or is there a way we want to start keeping that in our financials, where we’re looking at how we’re going to be paying that off?

Chairman Dekle: If you want that information, you can ask for it at any time. You don’t even have to wait for a meeting or work session. You can ask for that anytime. I don’t see any reason for us to change the way that we present our monthly financials. Does anyone else?

Philip Kent: Alex, how often are you tracking that? I think that’d be helpful for everybody to know that.

Alex Casado: So you’re only making debt payments twice a year. It doesn’t change daily or monthly even. It only changes twice a year.

Judy Teasley: And it’s only reported at that time, right?

Alex Casado: It will be reported on the financial reports but not necessarily here. That would be a separate request.

Katie Allen: Katie Allen: That’s more of a board question than an Alex question, because I know, Alex is more than happy to draw whatever financial reports we ask as a board. Do we want to start monitoring that every month to have a visual of what our collective bond debt is and how we’re looking at that each year, every five years, how many slots we’re looking into as far as paying that amount off? Because it almost seems like the way I saw this report, why I wanted to ask, is it seems like even as we’re claiming the full proceeds and putting it into our budget to use, in addition to the sales tax of the splost, we’re only accounting under the liability, the expenditure aspect of it, an incremental amount of the payments and then that pushes the majority of the payments into the future and out of sight for us. And so is there a way that we can maybe account for, even though in this five year period we’re only budgeting 64.8 million in principal and interest payments because that’s what’s due in the five years, if we’re going to be using the bond proceeds, 103 million plus the sales tax proceeds, 235.4 million. And putting all of that together in a spending plan, it seems like we’re spending all the bonds proceeds in five years, but not really having a full plan and paying back the full amount of the principal and interest payments. So is there a way we want to keep our eyes on that or is that something that we’ll deal with in 2032 during the next splost?

Chairman Dekle: I don’t think we need to change anything. I think the CFO is keeping an eye on it and he’ll report to us.

Board Policy JAA, Equal Educational Opportunities. Approve: Yay 5, No 0

Discussion Topics and Presentations:

Inspire School Spotlight, Steve Cummings

Greenbrier High School: Chip Fulmer (Principal) , Stephanie Fry, Andrea Smock

Greenbrier High School reported strong academic and extracurricular outcomes driven by a collaborative, accountability-focused culture. They pointed to expanded AP participation, pathway completion, and industry-aligned instruction, which is supported by schoolwide CER writing, data-informed teaching, and career-focused programs, as key factors behind rising achievement and success in athletics, STEM, and workforce certifications.

Budget & Legislative Outlook, Alex Casado

District preparing FY26–27 budget. Stable state funding but rising employee benefit costs

Legislative session began January 12; governor proposed a $2,000 teacher stipend pending approval, which could affect the FY26 amended budget and FY27 planning

Budget will be adjusted as needed to align with any state funding amendments

TRS employer contribution increasing from 21.91% to 22.32%, adding roughly $1 million

Health insurance premiums rising 7.5%, increasing employer costs by about $4 million annually; health costs have doubled over four years

About 70–80% of employees are state-funded, offsetting roughly 70% of benefit increases through state revenue

Net local impact of benefit increases exceeds $1 million

Revenue mix is approximately 60% state QBE funding and 40% local taxes

Current millage rate is 16.234 mills, lower than prior years

Net tax digest grew 46.57% over five years, with strong collection rates (95–98%)

State per-pupil expenditure is $12,155 per FTE, ranking Columbia County 7th lowest in Georgia, up from $11,546 in FY24

Budget timeline: full presentation April 21; public input meetings April 28 and May 12; tentative approval in May; final approval June 16

District monitoring legislative developments but anticipating funding levels similar to last year

Annual Audit Review

Independent audit. Strong financial controls and full compliance, with no significant findings

Auditor John Snyder issued clean opinion, confirming accurate financial reporting and adherence to accounting standards

Audit covered government-wide and fund-level statements, including detailed disclosures of long-term liabilities and bond schedules through 2037

No material weaknesses or significant deficiencies identified in internal controls or federal program compliance

New GASB requirement added liabilities for unused sick leave, incorporated after coordination with district finance staff and noted in audit.

Audit process allows for minor corrections prior to final issuance and timely communication with board leadership if larger issues arise

In response to Katie Allen’s question about a schedule, Mr. Snyder clarified that splost project cost reporting: $160 million reflects the voter-approved cap, while $313.5 million represents updated total project estimates including change orders

Difference in figures is a legal accounting distinction, not an error, and requires context to avoid misunderstanding

Staff Reports

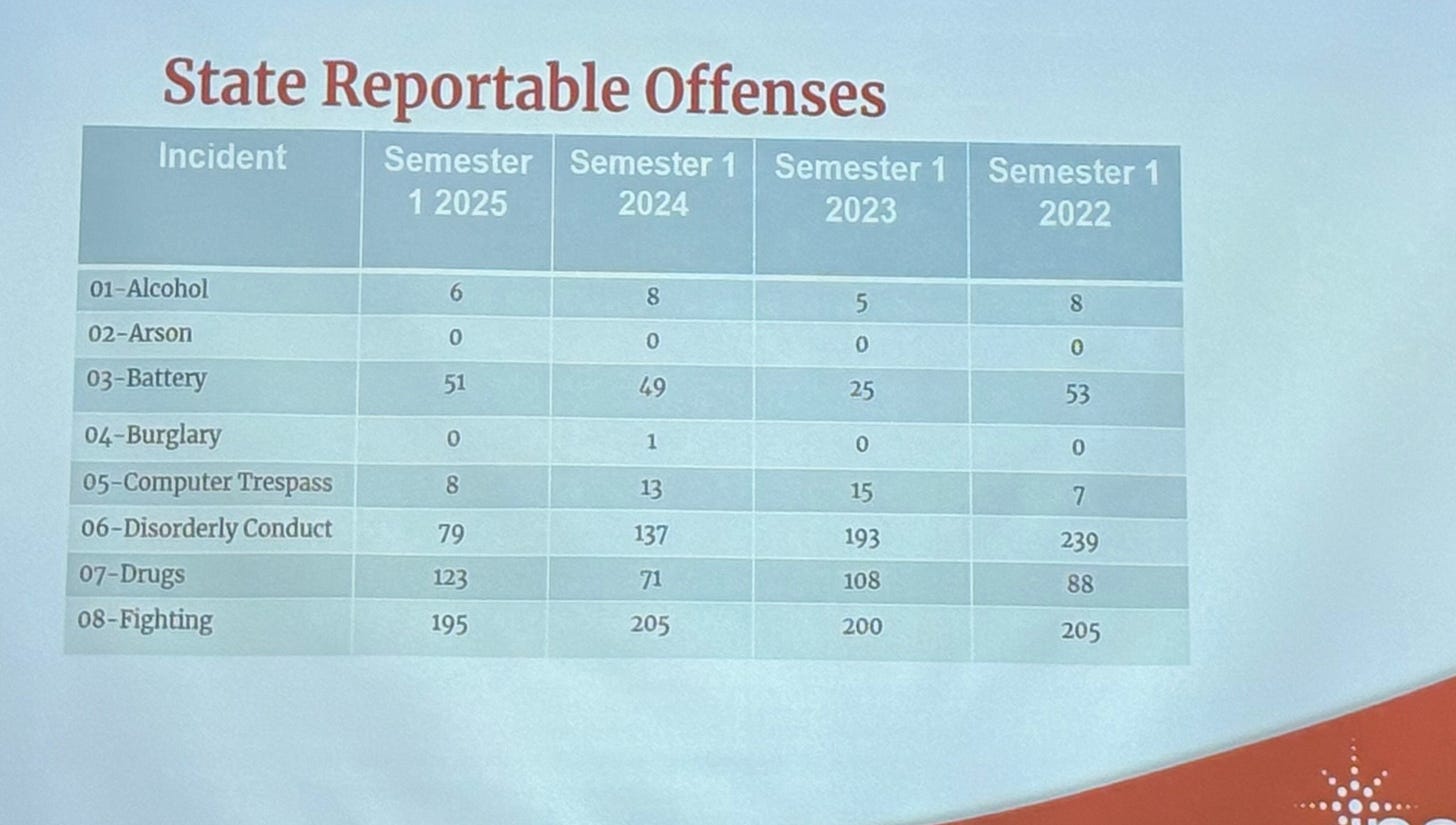

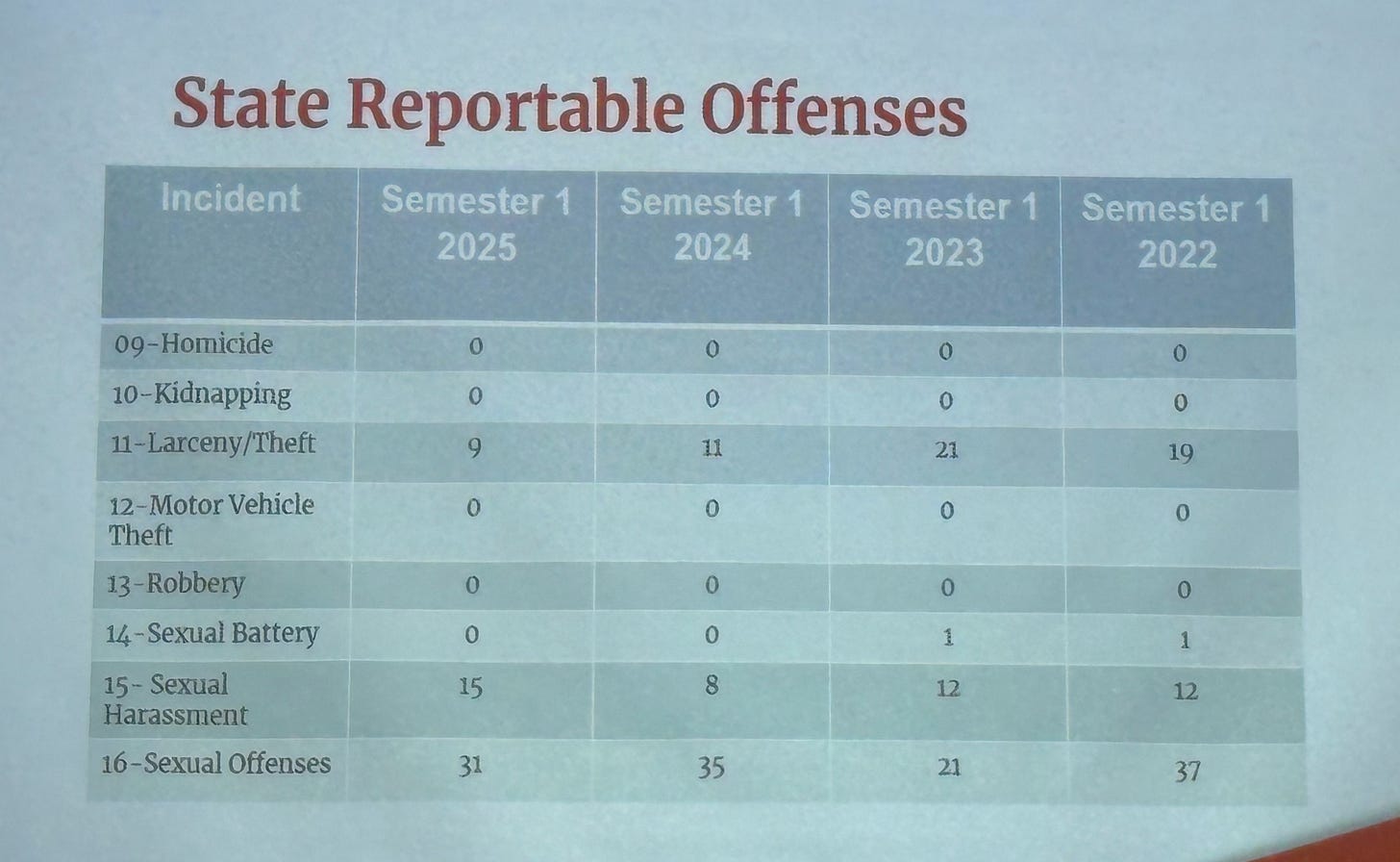

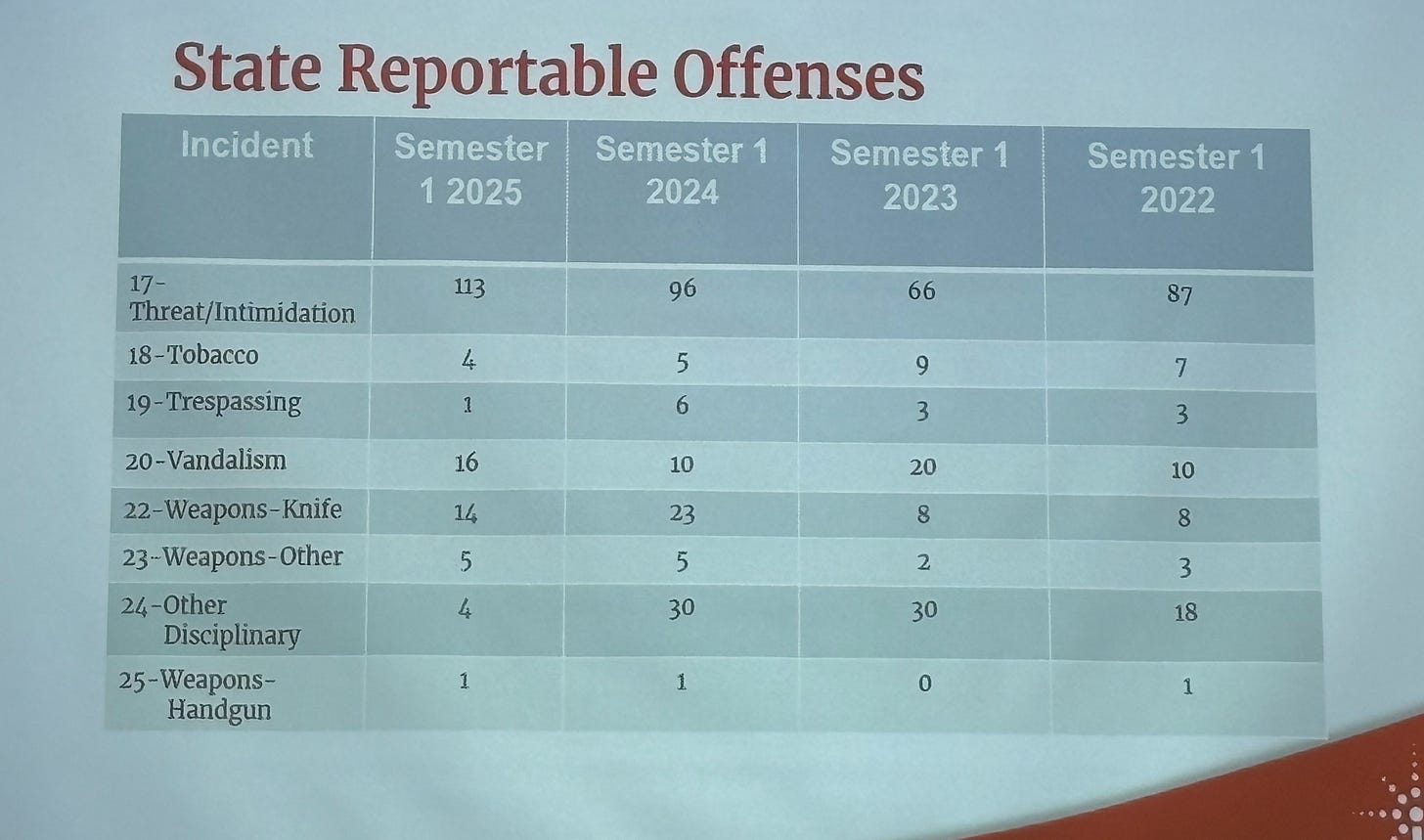

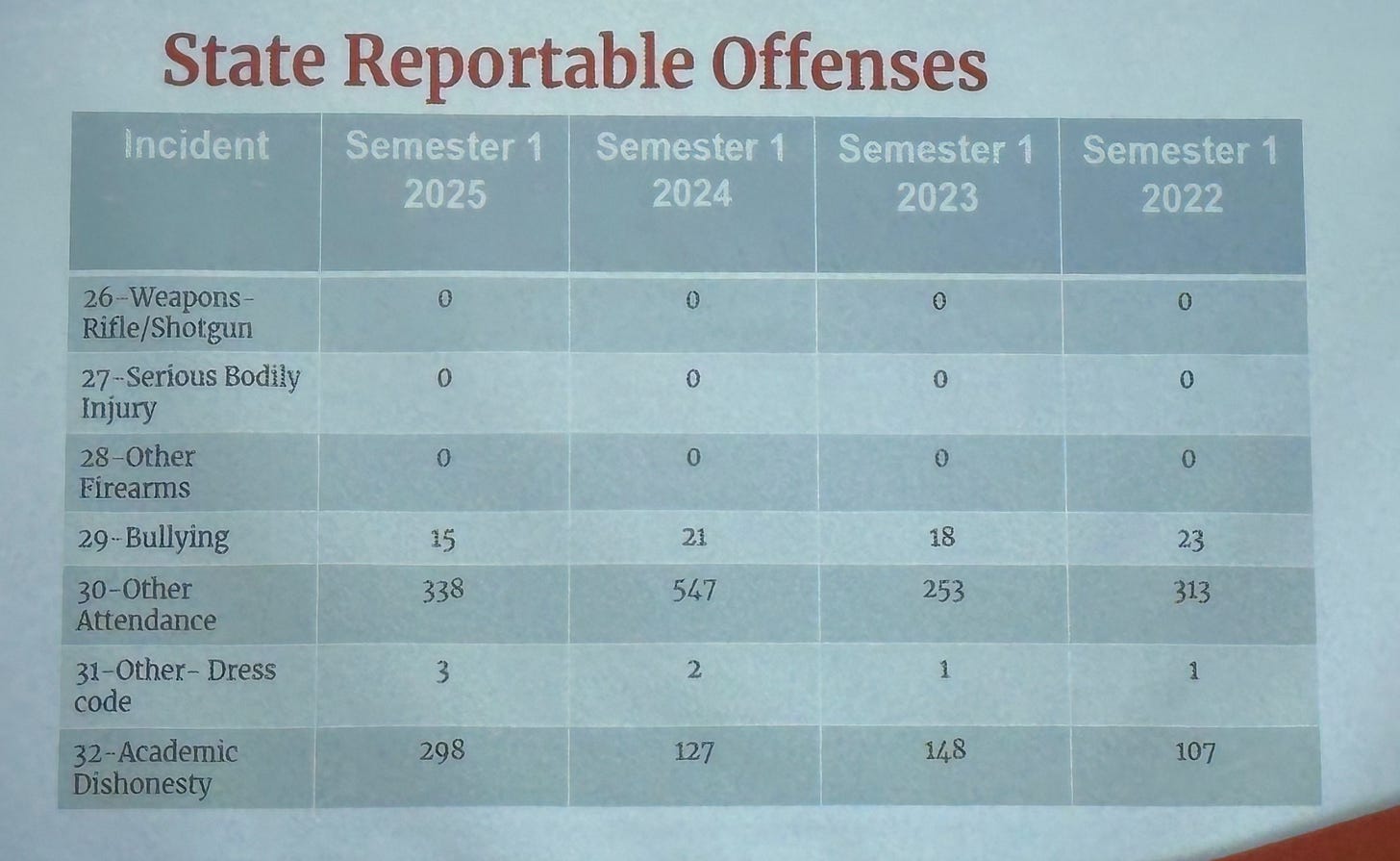

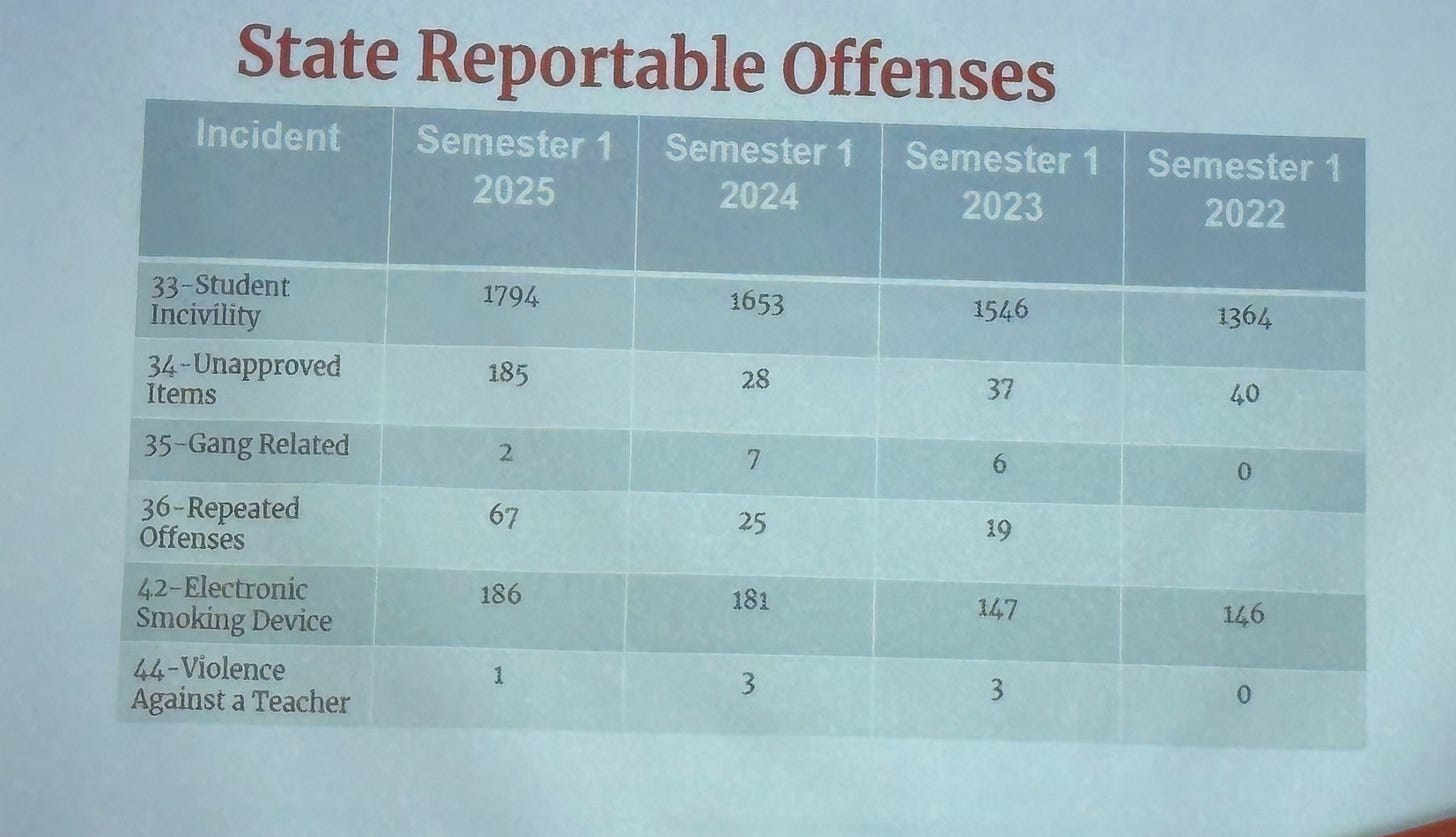

Behavior and Discipline Update, Penny Jackson

District reports a firm but supportive approach to student behavior, with heightened attention to threat assessment and drug-related offenses

Over 99% of students consistently make positive choices

Drug-related incidents have increased, driven largely by THC vape use

Alcohol-related incidents, fighting, and disorderly conduct have declined

Vape detectors have led to higher detection and enforcement of vaping violations

Progressive discipline is used, ranging from detention to suspension

Disciplinary hearings have increased, particularly for drug offenses and reentry cases

District uses a Behavior Threat Assessment and Management (BTAM) process, required under House Bill 268

Threat levels are classified from unfounded to high, with structured documentation of concerns and histories

Multidisciplinary teams (administrators, SROs, counselors, special education staff) coordinate responses

High-risk cases move to formal hearings with documented evidence and due process

Academic dishonesty has increased, including plagiarism and AI-assisted cheating

District is monitoring AI use and developing classroom policies and guidance

Technology presents both new cheating risks and improved detection tools

Ongoing teacher training and student instruction emphasize appropriate technology use

Communication with parents is prioritized, especially for repeat or disruptive behavior

Administrators emphasize due process, evidence-based decisions, and early reporting to prevent escalation

Special Education Update, LeAnne Gregg and Sharard Pritchett

District continuing to expand special education supports through training, leadership, and staffing strategies

Ongoing professional development for special education staff, including exemplary IEP training and leadership forums

Focus on improving instruction, compliance, and behavior supports

Monthly cluster meetings and newsletters used to share resources and maintain communication across schools

Upcoming events: Transition Resource Fair (Feb 28) and Special Education Olympics (Mar 27)

FY26–27 budget includes incentives and release time for special education teachers to collaborate on planning and data collection

Each school will have a dedicated Special Education Department Chair with no classroom teaching duties

Department Chair role centers on staff support, coaching, and compliance oversight

New leadership structure intended to strengthen instructional quality and service delivery

Consultant Paula Everett continues to support compliance and program improvements following a needs assessment

Katie Allen asked how long she had been working with district. Since the needs assessment was done in Fall 2023.

Program effectiveness monitored through state complaint trends and ongoing training

Katie Allen also inquired about tracking complaints over the past 10 years through both State and Federal. Pritchett responded that State complaints are inevitable, part of the parent’s advocacy rights, and that State will say if district is compliant or non-compliant.

Parent input gathered through surveys and resource fairs

District will distribute a survey soon to all special needs parents.

District plans to improve communication channels and respond more quickly to parent concerns

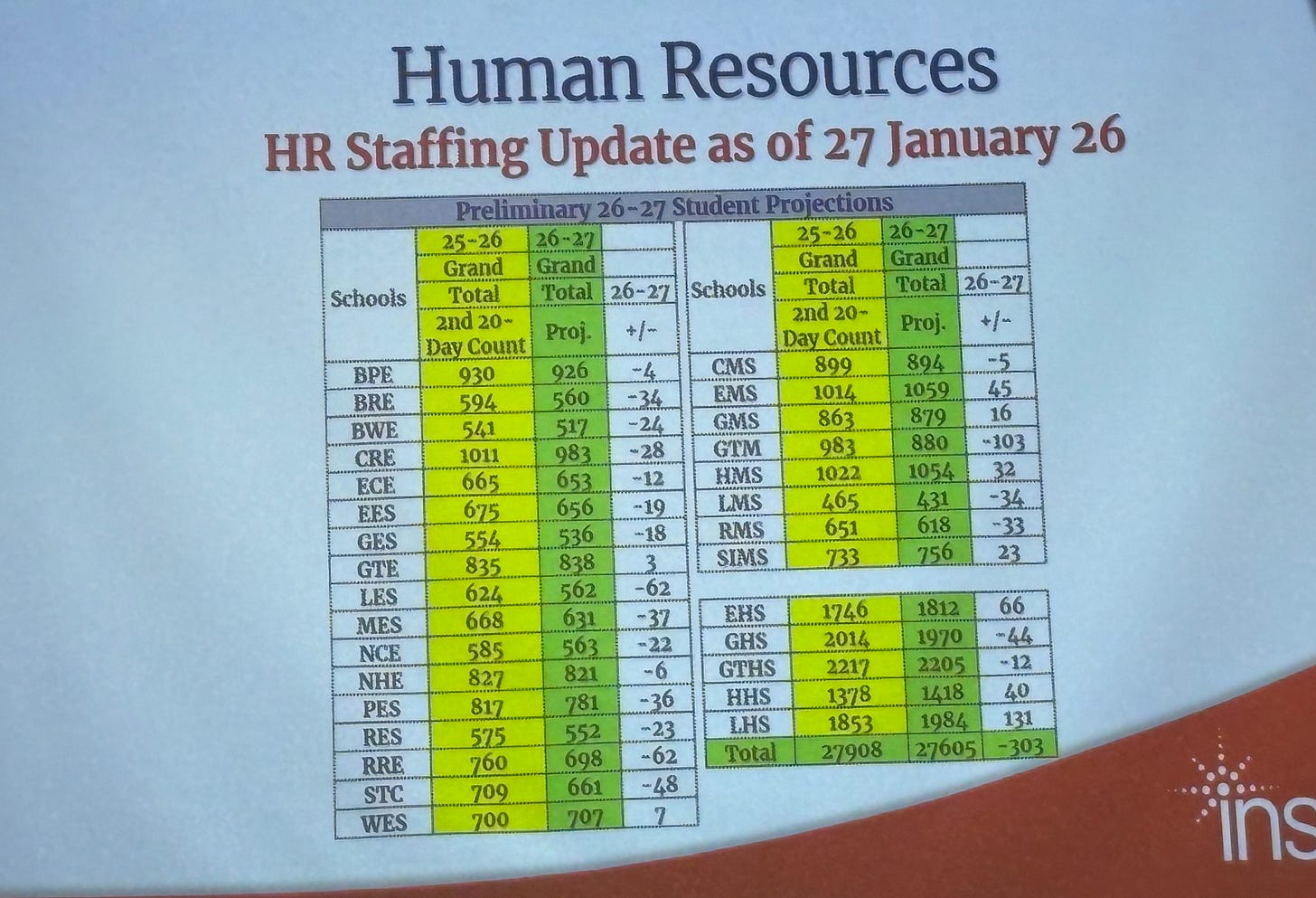

Staffing Update, Tony Wright (HR)

Human Resources projects a student enrollment decline of approximately 300 students next year

Staffing will be aligned using weighted student allocations that prioritize student needs over raw enrollment

Weighted staffing has increased overall staff levels despite declining enrollment

Approach helps maintain or reduce class sizes and better support ESOL and special education populations

Hiring for the 2026–27 school year will prioritize special education and other high-need areas

Schools will receive enrollment and staffing projections soon to develop site-based staffing plans

Enrollment decline largely driven by lower kindergarten cohorts following COVID

No significant shifts expected in other student categories

Enrollment projections based on both internal district data and McKibben & Associates

Building Program Project Update:

Lakeside HS: New Media Center, Cafeteria/Kitchen in use. Gym - steel is placed

Evans HS: Roofs on. Move in start this summer. New gym/cafeteria ready at start of next school year.

Harlem HS: Site Work Started

Katie Allen asked if there was a plan for the traffic. She had concerns about the number of traffic accidents.

Changes to the flow of traffic with construction helped to get vehicles off the road.

Greenbrier HS: Architect should have designs soon. Katie Allen asked for copies of the contract payer request to be emailed to her.

Upcoming Dates:

Progress Reports, 2/5/2026

Career, Technical and Agriculture Education Workforce Showcase and Competition, 2/6/2026

Presidents’ Day Holiday, 2/16/2026

Pre-K Registration, 2/23/2026 - 3/20/2026

End of 3rd Nine Weeks, 3/10/2026

Columbia County College and Career Expo, 3/12/2026

Early Dismissal/Parent Conferences, 3/13/2026

Student Holiday/District Professional Learning Day, 3/16/2026

Columbia County School District Foundation Top Golf Even, 3/16/2026

Report Cards, 3/18/2026

Pre-K Drawing, 3/30/2026

Approval of Personnel Sheet: Yay 5, No 0

Adjourn: Yay 5, No 0 Approximately 8:30 pm

Next Meeting: Regular Session 2/10/2026 at 5:30 PM 4781 Hereford Farm Road, Evans GA