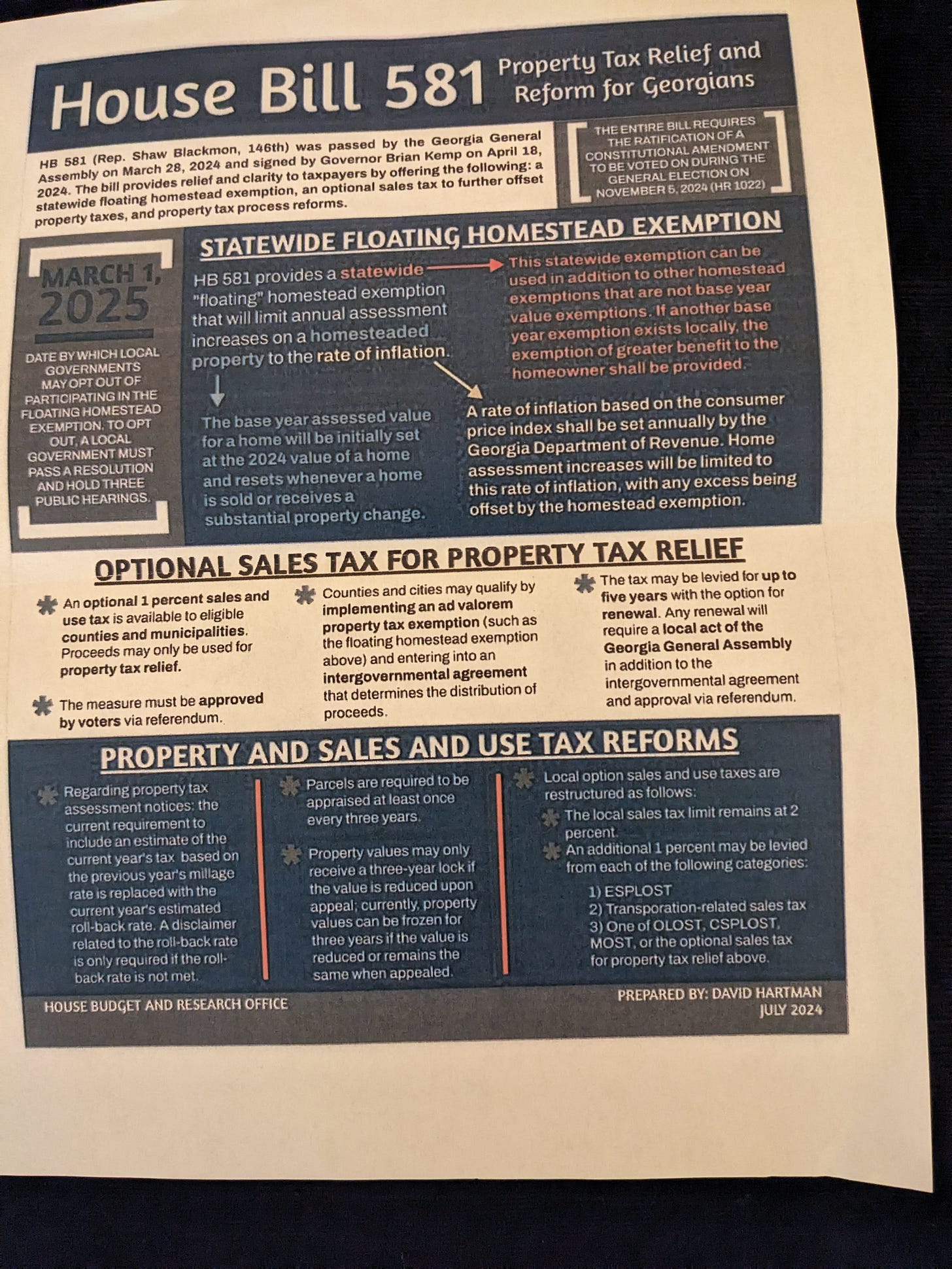

*A picture of an HB581 Handout is posted at the end.

A. Call to Order

B. Invocation

C. Pledge of Allegiance

D. Roll Call / Quorum

E. Presentation and Approval of the Agenda

F. Discussion of the Impacts of House Bill 581 Homestead Exemption

- Because of inclement weather during this first of three required meetings on the subject, the Board will hold a fourth meeting for public discussion on 18 Feb 2025.

- Chairman Duncan clarified that the language posted in the public notice of the BoC meetings is the language required by law. The law requires the notice be posted as a meeting to consider “opting out”. Chairman Duncan indicated his feeling that the Board was more inclined at this point to opt in but the notice was posted as required.

- Vote to opt out must be held by 01 March 2025

- County Manager Scott Johnson explained the details of H.B. 581

- still working on understanding the full meaning of the details

- Opting in allows BoC to levy up to an additional 1% sales tax to recoup lost revenue

*During this discussion Chariman Duncan and Commissioner Carraway both stated they prefer a sales tax because they see it as a “fair tax” because it applies to everyone and not just homeowners

- Mr. Johnson noted that the BoC has a budget cycle between March and November that would be impacted by the decision to opt in as any new sales tax could not go into effect until approved by an election in November.

- Addressing how the homestead exemption would be applied: there will not be multiple valuations for homeowners falling under multiple taxing jurisdictions (county, municipality, school district); there will still only be one valuation and the exemption will be applied as a credit by entities that opt in.

- All taxing entities can still change millage rates to adjust revenue

- There seems to be an incomplete understanding of how a potential sales tax increase would be applied/distributed. If the County opts in and increases the sales tax to cover lost revenue, the commissioners’ view is that this would not be shared with entities (municipalities, school district) that opt out. However, if other entities opt in as well, the increased sales tax revenue would be distributed among all that opt in.

G. Public Comments and Participation

*Five citizens addressed the Commission with comments and questions regarding H.B. 581. A summary of their statements follows with names redacted.

Speaker 1: Encouraged the Commission to opt out. This speaker did not believe that voters understood the ballot measure in November and that most would have voted against the Amendment had they understood the context. They noted that the ballot measure did not reference H.B. 581 in any way and so voters would not have known that this bill was the real issue on the ballot. (*There was general agreement that both H.B. 581 and the November ballot measure were confusing and poorly worded.) This speaker addressed how opting in would further complicate the tax system and that the Commissioners should consider this because they can never reverse their decision and opt out later. (*The fact that the choice to opt in or out must be made by 01 March 2025 and cannot be changed later was another issue discussed at some length.)

Speaker 2: This speaker was primarily frustrated at the continued increases in tax valuations and the impact that it has on seniors, retirees, and others on a fixed income. They indicated they were not sure whether relief was best served by opting in or out but were adamant that something had to be done. Board members and Mr. Johnson addressed that their control over valuations is limited as it must stay within margins set by the state and the BoC had been warned recently that they were failing to do so. Millage rates were also addressed as another way the Board can reduce the tax burden on homeowners.

Speaker 3: This speaker was upset that the Board members were still confused about the bill and their options as they had known this was coming since April with H.B. 581 was originally passed. Reiterated the sentiment that tax assessments are too high and recommended opting in. The speaker addressed the savings and available funds the Board has to make up for any lost revenue.

Speaker 4: This speaker recommended opting out of the H.B. 581 tax exemption because of their view that assessed value is fairer than increasing millage rates as it is more reflective of the value gap between different properties.

Speaker 5: This speaker had questions about what percentage of the property tax bill is represented by different entities. The Board said ~70% is the school district and ~30% is the County (they did not address the breakdown for those also paying municipal property taxes in Grovetown or Harlem). This speaker felt it was important for different taxing entities to be on the same page as it seemed clear the tax system would be more confusing with some choosing to opt in and others choosing to opt out.

Meeting Adjourned